The Carbon Tax will be introduced on July 1st; the opposition has a ‘blood pledge’ to repeal when it is elected.

Is it feasible to attempt to unscramble the egg? Below is a Fairfax article (Madelein Heffernan) on Deutsche Bank looking at Tony Abbott’s ‘blood pledge’.

Add to that the bipartisan commitment to cut emissions by 5% below 2000 levels by 2020, and the prospect for the future looks complex and….. confusing enough to be scary.

Carbon tax repeal not so easy

Madeleine Heffernan; May 9, 2012

Utilities are likely to recover additional costs due to the carbon tax through higher electricity prices.

IT IS Opposition Leader Tony Abbott’s ”pledge in blood”: repeal Labor’s price on carbon. And with polls putting Labor’s primary support at below 30 per cent, it’s a prospect that warrants reflection.

But as the Minister for Mental Health and Ageing, Mark Butler, has pointed out, promises to repeal complicated laws are difficult to pull off.

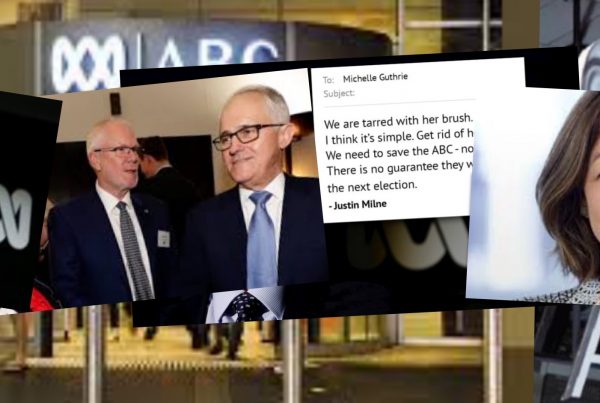

”Well, we tried rollback on the GST; it didn’t work. This is the mother of all rollback campaigns,” Butler told Q&A on ABC television this week.

Deutsche Bank has looked into the Coalition’s promise to repeal the carbon tax and said it might not happen until April 2014 – nearly two years after the legislation takes effect in July this year.

”Each step in the constitutional process takes time, and in practice, it could take eight to 14 months for the repeal bills to pass, with risks of further delay at each stage of that process,” research analyst Tim Jordan wrote in a report released yesterday.

”On that timetable, the earliest a repeal bill could pass after an August 2013 election would be April 2014, 22 months after the carbon price comes into force.”

Assuming the Coalition wins the next election but is not granted control of the upper house, Labor and the Greens are unlikely to repeal the price on carbon, leaving Abbott with the option of calling a ”double dissolution” – or fresh election on all seats of Parliament. If the double-dissolution election failed to give the Coalition control of both houses of Parliament, it could call a ”joint sitting” to pass the contested legislation, provided it had a majority of seats in the two houses combined.

But whether this is the ideal outcome is another issue. Mr Jordan said abandoning a market mechanism for reducing emissions would ”only provide a temporary reprieve for major emitters”.

”The carbon price is likely to have a modest impact on most listed emitters: most high-carbon firms in trade-exposed sectors will receive free units (and in the case of steel makers, cash grants) to offset the impact; resources companies face a small impact relative to earnings; airlines will pass on the cost in ticket prices; and utilities are likely to recover most of their additional costs through higher electricity prices,” he wrote.

Labor and the Coalition have a bipartisan commitment to cut emissions by 5 per cent below 2000 levels by 2020.

Mr Jordan told BusinessDay that this commitment would still stand if the carbon tax was repealed and would probably be met through state-based or ad hoc programs.